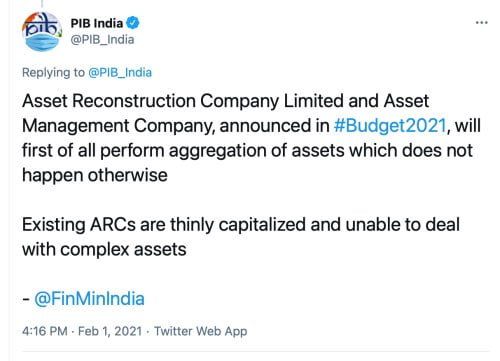

Finance Minister Nirmala Sitharaman has announced the setting up of an entity to address the stressed assets of banks. Presenting her third budget, FM Sitharaman proposed the creation of an asset reconstruction company (ARC) and an asset management company (AMC) to clean up non-performing assets (NPAs) in the banking sector. The new entities will help effectively deal with NPAs. This institution, what is commonly known as ‘bad bank’, has been in discussions for long.

“An Asset Reconstruction Company Limited and Asset Management Company would be set up to consolidate and take over the existing stressed debt and then manage and dispose of the assets to Alternate Investment Funds and other potential investors for eventual value realization,” the finance minister said while unveiling the Budget for 2021-22.

Also Read: Why SBI, ICICI and HDFC Bank are ‘too big to fail’

Bankers have welcomed the move to set up a bad bank for toxic debts. Although no details are available on the amount of capital the government plans to allocate.

What is Bad Bank?

A ‘bad bank’ is a bank that buys the bad loans of other lenders, financial institutions. The entity holding significant NPAs will sell these holdings to the bad bank at market price. By transferring such assets to the bad bank, the original institution may clear its balance sheet. Former chief economic adviser Arvind Subramanian in 2017 recommended setting a bad bank. Former RBI Governor Raghuram Rajan rejected the idea.

Also Read | FM Nirmala presents Union Budget 2021: Highlights

At the end of September 2020 year, the total gross NPAs of the banking system was 7.5 per cent of the overall industry loan book. This is expected to shoot up to 13.5 per cent by March-September this year, according to the Reserve Bank of India’s (RBI) projection.

Govt to pump Rs 20K crore into PSBs

The government will infuse Rs 20,000 crore into public sector banks (PSBs) in 2021-22 to meet the regulatory norms. For the current financial year also, the government had made a provision of Rs 20,000 crore for recapitalisation.

“To further consolidate the financial capacity of PSBs, further recapitalization of Rs 20,000 crores is proposed in 2021-22,” she said while presenting the Budget 2021-22 in the Lok Sabha.

Despite COVID-19, Government has kept working towards strategic disinvestment. The Budget proposals for 2021-22 put Rs 1.75 lakh crore as a target from stake sale in public sector companies and financial institutions.

“Several transactions — Bharat Petroleum Corporation Ltd, Air India, Shipping Corporation of India, Container Corporation of India, IDBI Bank, BEML, Pawan Hans and Neelachal Ispat Nigam Ltd — among others are proposed to be completed in FY 2021-22,” she told Parliament.

Also Read: No change in income tax slabs but relief for whom?

Other than IDBI Bank, a proposal of privatisation of two public sector banks and one general insurance company will be taken up in the year 2021-22. The initial public offering of Life Insurance Corporation (LIC) will also be brought in through requisite amendments in the session itself.

Sitharaman said the government has approved a policy of strategic disinvestment of public sector enterprises that will provide a clear roadmap for disinvestment in all non-strategic and strategic sectors.

This is the first budget after the Covid-19 pandemic and the ninth one under the Modi government. Also, this was the first paperless budget in the history of India.

RBI to lenders: Stop charging compound penal interest on loans

Why women must take care of their finances

Axis-Citi deal: What changes for Citibank cardholders in India